Unpacking Angelo Mozilo's Net Worth: A Look At A Complex Financial Legacy

Have you ever wondered about the financial stories behind major historical events, especially those that shook the economy? Well, the story of Angelo Mozilo, a very prominent figure in the world of finance, is one that, you know, really stands out. He was, in a way, at the heart of the housing market's massive ups and downs, particularly during a time when things got, frankly, quite tricky for a lot of people. His personal wealth, and how he got it, is something that, you know, many folks have been curious about for a long time.

It's interesting to consider how someone can build such a significant fortune, yet also be so closely tied to a period of such great economic trouble. Angelo Mozilo's name, you see, often comes up when people talk about the 2008 financial crisis, and his company, Countrywide Financial, played a rather big part in that whole situation. So, understanding his net worth isn't just about a number; it's about looking at a piece of financial history, and, you know, the choices that were made.

This article will, in some respects, try to make sense of Angelo Mozilo's financial standing, drawing from what we know about his career and his later years. We'll explore the details of his wealth, the company he built, and the impact he had, which, for many, was quite significant. So, if you're curious about the money side of things, and the story of a man who was, basically, a king of mortgages, then keep reading.

Table of Contents

- Angelo Mozilo: A Brief Biography

- Personal Details and Bio Data

- The Ascent of Countrywide Financial and Wealth Accumulation

- The 2008 Crisis and Its Aftermath

- Angelo Mozilo's Net Worth at the Time of His Passing

- A Legacy of Wealth and Controversy

- Frequently Asked Questions About Angelo Mozilo's Net Worth

Angelo Mozilo: A Brief Biography

Angelo Mozilo, who, you know, was a very well-known American executive, built a career that, frankly, left a huge mark on the financial world. He was the kind of person who could, in a way, see opportunities where others might not. He helped create Countrywide Financial, which, basically, became one of the biggest mortgage lenders in the whole country. This wasn't just a small operation; it grew into a behemoth, as some might say.

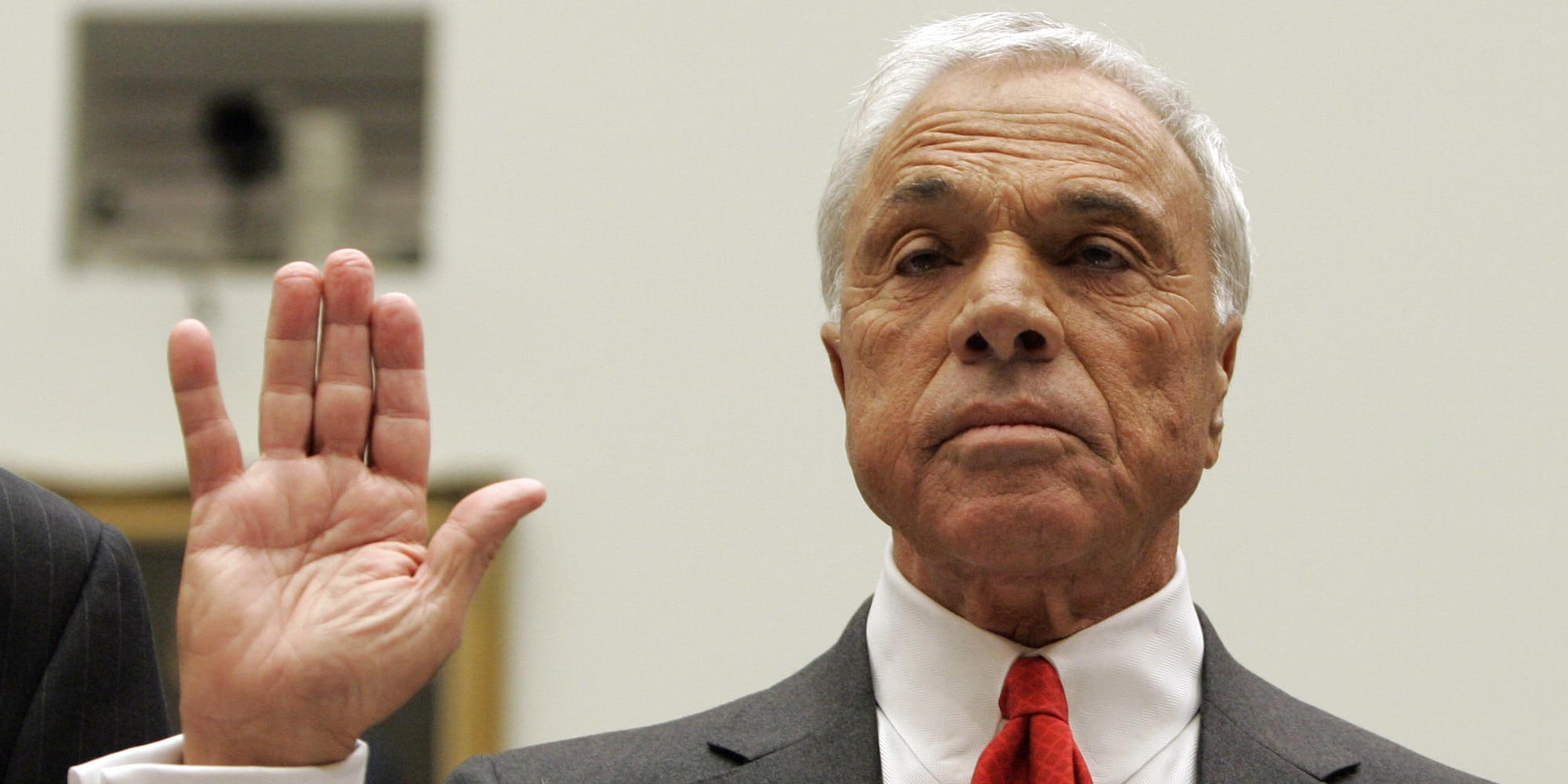

His journey wasn't always smooth, and, you know, he eventually presided over the company's collapse during the 2008 financial crisis. That period, as a matter of fact, was a very tough time for a lot of people, and Countrywide's troubles were, in some respects, a symbol of the larger problems in the housing market. He passed away in July 2023 at the age of 84, which, you know, was a natural end to a life that had seen so much.

Mozilo was, basically, known as the "king of mortgages," a title that, you know, really shows just how influential he was in that industry. He was a person who, as I was saying, shaped how many people got their homes, and his story is a really big part of the history of American finance. It's a tale of ambition, success, and, you know, eventually, a great deal of public scrutiny.

Personal Details and Bio Data

To give you a clearer picture, here are some key details about Angelo Mozilo:

| Full Name | Angelo R. Mozilo |

| Date of Birth | Not specified in provided text, but lived to 84. |

| Date of Death | July 2023 |

| Age at Death | 84 |

| Cause of Death | Natural causes |

| Nationality | American |

| Occupation | Executive, Former Chairman and CEO of Countrywide Financial |

| Known For | Building Countrywide Financial, role in 2008 financial crisis, "King of Mortgages" |

| Estimated Net Worth at Death | $600 million |

The Ascent of Countrywide Financial and Wealth Accumulation

Angelo Mozilo's journey to becoming a very wealthy man is, in a way, tied directly to the growth of Countrywide Financial. He, along with his business partner, built this company from, you know, what was a smaller beginning into a really massive force in the mortgage world. For a long time, Countrywide was, basically, the largest U.S. mortgage lender, which, you know, is quite an achievement when you think about it.

His leadership at Countrywide allowed him to, in some respects, amass a very impressive fortune. As the company grew, so did his personal wealth, which is, you know, typically how these things work for top executives. The text mentions that his net worth, even after Countrywide's downfall, was estimated to be somewhere between $300 million and $600 million. This shows, frankly, just how much money he had accumulated over his career.

It's interesting to note that he also had other financial interests. For example, Angelo R. Mozilo was, apparently, a director of The Home Depot Inc. and, you know, owned about 5,000 shares of that company. This suggests that his financial portfolio was, perhaps, a bit more diverse than just his Countrywide holdings, which, you know, adds another layer to his wealth story. He was, in a way, a very savvy person when it came to managing his money.

His wealth was not just in direct company shares, either. The text points out that he managed to, basically, "sock away millions in a charitable organization run by family members." This is, you know, a common strategy for very wealthy individuals, and it speaks to the scale of his assets. So, his financial picture was, in fact, quite complex, with money held in different forms and places.

The 2008 Crisis and Its Aftermath

The story of Angelo Mozilo and Countrywide Financial, however, took a very dramatic turn with the 2008 financial crisis. This period was, as a matter of fact, a huge challenge for the entire global economy, and the housing market was, you know, at the very center of it. Countrywide, which had been so successful, almost went bankrupt during this time, which, you know, must have been incredibly stressful for everyone involved.

Mozilo himself became, in some respects, a very public face of that crisis. His company's lending practices were, basically, under intense scrutiny, and he faced a lot of criticism. The text mentions that he settled a suit with the SEC, which, you know, is the Securities and Exchange Commission, an important regulatory body. This shows that there were, indeed, legal challenges he had to deal with after the company's difficulties.

Even after the crisis, his legal troubles weren't entirely over. It turns out, according to the text, that Angelo Mozilo was, apparently, "not yet in the clear with the US government, which reportedly is preparing a new lawsuit against the architect of the behemoth US mortgage firm Countrywide Financial." This suggests that the impact of the crisis, and his role in it, continued to follow him for quite some time, which, you know, is a heavy burden to carry.

Despite these very serious issues, his personal wealth remained substantial. The estimates of his net worth, even after all the legal battles and the company's collapse, were still in the hundreds of millions. This is, you know, a testament to the sheer amount of money he had accumulated during Countrywide's peak years. It's a rather striking contrast between the company's fate and his personal financial standing.

Angelo Mozilo's Net Worth at the Time of His Passing

When Angelo Mozilo passed away in July 2023, his net worth was, you know, quite a significant figure. The information available indicates that he had a net worth of $600 million at that time. This amount, as I was saying, reflects the impressive fortune he had built through his very successful career in the business world, even with all the challenges he faced later on.

It's important to remember that these figures are, you know, often estimates based on reported shares and other assets. The text mentions that his wealth since Countrywide’s downfall had been estimated at between $300 million and $600 million. So, reaching the $600 million mark at the time of his death suggests that his financial situation had, in some respects, stabilized or even grown in the years leading up to his passing.

His position as a director at The Home Depot Inc. and his ownership of shares there, as we discussed, also contributed to his overall financial picture. This demonstrates that his wealth wasn't solely tied to Countrywide, but rather, you know, diversified across different investments. It's pretty clear he was, basically, a very astute individual when it came to managing his money, even through turbulent times.

The fact that he was listed among the "richest bankers in the world," as the text suggests, also gives us a sense of the scale of his fortune. While he might not have been the absolute richest, being on such a list means his wealth was, you know, truly exceptional. His financial journey is, in a way, a remarkable one, full of ups and downs, but ultimately, very lucrative for him personally.

A Legacy of Wealth and Controversy

Angelo Mozilo's story is, in some respects, a very complex one, marked by both immense financial success and significant controversy. He was, basically, a titan in the mortgage industry, transforming how many Americans bought their homes. His vision, you know, helped propel Countrywide to unprecedented heights, making him a very powerful figure in finance.

However, his legacy is, you know, also intertwined with the pain and disruption of the 2008 financial crisis. For many, he became a symbol of the excesses that led to that economic downturn. The legal actions against him, and the public's perception of his role, are a big part of his story, which, you know, can't be ignored when talking about his wealth.

Even after his passing, his story, you know, continues to be discussed. "Angelo Mozilo may no longer be with us, but his story lives on," the text says, which is, you know, very true. His impact on the real estate and financial industry, both positive and negative, is something that, basically, shaped a significant period of American economic history. You can learn more about financial market dynamics on our site.

His net worth, then, is not just a number. It's, in a way, a reflection of a life lived at the very top of the financial world, a life that, you know, had a profound effect on millions of people. It shows how much money can be made, and, you know, how much responsibility comes with that kind of power. To understand more about the individuals who shape our economy, you might want to link to this page about influential business leaders.

Frequently Asked Questions About Angelo Mozilo's Net Worth

What was Angelo Mozilo's net worth at the time of his death?

Angelo Mozilo had a net worth of $600 million at the time of his passing in July 2023. This figure, you know, reflects his substantial fortune accumulated over a long career in the business world, particularly as the head of Countrywide Financial. It's a very considerable amount, as you can probably imagine.

What company did Angelo Mozilo found or lead?

Angelo Mozilo was the former chairman of the board and chief executive officer of Countrywide Financial. He, basically, built this company into one of the nation's largest mortgage lenders. So, his main company was Countrywide, which, you know, became very well-known.

What was Angelo Mozilo's role in the 2008 financial crisis?

Angelo Mozilo, as the head of Countrywide Financial, presided over its collapse during the 2008 financial crisis. His company, which was the largest U.S. mortgage lender, almost went bankrupt. He became, in some respects, a very prominent public figure associated with the crisis and faced legal actions related to his company's practices, which, you know, was a very challenging time for him and for the country.

Former Countrywide CEO Angelo Mozilo says crisis wasn't his fault

Angelo Mozilo Net Worth - Net Worth Post

Phyllis and Angelo Mozilo