Michael Burry: The Investor Who Saw It Coming And His Latest Market Views

Have you ever wondered about the person behind the legendary market calls, the one portrayed in a famous movie for spotting a huge financial problem before almost anyone else? Well, that's Michael Burry, and his story, it's almost a legend in the world of money. He is best known for being among the first investors to predict and profit from the subprime mortgage meltdown, a truly remarkable feat that changed many lives and, in a way, reshaped our economy. People often talk about his sharp insights and how he seems to look at things differently, seeing what others miss.

Michael Burry is a hedge fund manager, you know, someone who runs a big pot of money for other people, and he is very much renowned for founding a company called Scion Capital. This place, Scion Capital, later started going by the name Scion Asset Management, so it's the same idea, just a different name. He made his name, quite simply, by betting against the housing market back in 2008, a time when most people thought everything was just fine. It was a bold move, and it certainly paid off in a big way for him and his clients, too.

What makes Michael Burry so interesting, you might ask? Well, it's his knack for seeing patterns and risks where others see stability. His recent actions, particularly with his Q1 2025 portfolio, apparently show a dramatic shift. He has taken an extremely bearish stance, which means he thinks things are going to get rough for the market. This article will help us look closely at his journey, how he figured out the 2008 housing trouble, and what his current bets might tell us about the future, so to speak.

Table of Contents

- Who is Michael Burry?

- Personal Details and Background

- The Big Call: Predicting the 2008 Housing Trouble

- Michael Burry's Investment Approach

- His Latest Market Moves: Q1 2025 Portfolio

- Frequently Asked Questions About Michael Burry

- What Michael Burry's Actions Might Mean Now

Who is Michael Burry?

Michael Burry is an American investor and a hedge fund manager, someone who handles money for a group of people, and he is very much well-known for his ability to foresee big economic shifts. He started his company, Scion Capital, back in the year 2000. For a good while, he ran this fund, making investment decisions that, as a matter of fact, often went against what most other people were doing. He has a way of looking at numbers and situations that is quite different from the usual, and that's what made him stand out, really.

His story became even more famous when he was shown in the movie "The Big Short." In that film, Christian Bale played his part, bringing to life how Burry saw the big housing market problem brewing. This movie, you know, helped a lot of people understand just how significant his early warnings were. He's not someone who just follows the crowd; he tends to look for problems and opportunities that others simply overlook, or so it seems.

Personal Details and Background

| Detail | Information |

|---|---|

| Full Name | Michael James Burry |

| Nationality | American |

| Occupation | Investor, Hedge Fund Manager |

| Known For | Predicting and profiting from the 2008 financial crisis |

| Founded | Scion Capital (later Scion Asset Management) |

| Portrayed By | Christian Bale in "The Big Short" |

The Big Call: Predicting the 2008 Housing Trouble

How He Saw It Coming

Michael Burry's claim to fame, the very thing that made him a household name, was his accurate prediction of the big housing market bubble bursting in 2008. He did this, it seems, by looking very closely at how banks were giving out home loans, especially what were called "subprime mortgages." These were loans given to people who had a harder time proving they could pay back the money, and he noticed that the risk tied to these loans was getting bigger and bigger, a bit like a balloon filling up with too much air. He saw that these loans were bundled together and sold off, and that was a huge problem, you know.

He recognized that the housing market, which everyone thought was strong and stable, was actually on shaky ground. He spent a lot of time digging through complex documents, just finding out all the details of these mortgage agreements. It was a lonely path, as many people around him, apparently, did not agree with his gloomy outlook. But he stuck to his guns, convinced that the way these loans were set up would lead to many people not being able to pay them back, and that would cause a very big problem for the entire system, so to speak.

Profiting from the Collapse

Once he had a clear picture of the coming housing market trouble, Michael Burry decided to act. He made his name, quite honestly, by betting against the housing market, which is called "shorting." This meant he would make a lot of money if the housing market went down, and that's exactly what happened. He managed to bring in an estimated $100 million for himself, which is a truly huge sum, and also a staggering $725 million for the people who had trusted him with their money, his clients, that is.

His ability to profit amidst such widespread economic turmoil really showed how unique his way of thinking was. While others were losing vast sums of money, he and his clients were gaining from the market's decline. This whole episode, you know, cemented his reputation as a visionary investor, someone who could see what others couldn't and act on it decisively. It was a very stark example of how, sometimes, going against the crowd can pay off in a big way.

Michael Burry's Investment Approach

Michael Burry's way of investing is, you know, quite distinct. He's not one to follow the usual paths or listen to the popular opinions on Wall Street. His method often involves deep research, looking into areas that most other investors ignore or consider too boring. He tends to search for situations where the market has, perhaps, misjudged the true value or risk of something. This contrarian view, meaning he goes against what most people believe, has been a hallmark of his career, you know.

He focuses on finding what he calls "mispricings" – where something is valued incorrectly by the market. This could be a company's stock, or in the case of 2008, it was the housing bonds. He digs into the numbers, looking for hidden dangers or overlooked opportunities. This kind of work takes a lot of patience and a willingness to be alone in your thinking, even when everyone else tells you that you're wrong. It's a bit like being a detective, just looking for clues that no one else sees, or so it seems.

His investment philosophy, you know, is very much rooted in fundamental analysis. This means he looks at the basic health and numbers of what he's investing in, rather than just following trends or rumors. He wants to understand the real underlying value, or lack thereof, of an asset. This detailed, almost obsessive, focus on the nitty-gritty details is what allowed him to spot the cracks in the housing market years ago. It's a reminder that sometimes, the most important insights come from looking where no one else bothers to look, you know.

His Latest Market Moves: Q1 2025 Portfolio

A Shift to Bearish Bets

Fast forward to today, and Michael Burry is still making headlines with his investment choices. His Q1 2025 portfolio, which was made public, reveals a truly dramatic shift in his outlook. It shows him taking an extremely bearish stance, which means he believes the market is headed for a downturn, possibly a big one. Out of seven positions he holds, six of them are what are called "put options." A put option is basically a bet that a stock or an index will go down in value, so it's a way to profit from a decline, you know.

This kind of move is very much in line with his history of seeing problems before they become obvious to everyone else. It suggests that he's identified some significant risks in the current market environment. The value of his Q1 portfolio, which was worth about $103 million as of the end of March 2024, shows that these are not small, casual bets. They represent a significant portion of the money he manages, suggesting a strong conviction in his bearish view, so to speak.

Notable Short Positions

Among the most notable moves in his recent portfolio, he has initiated what looks like a massive short bet. Michael Burry, who gained widespread recognition by calling the subprime mortgage trouble, has now loaded up on bearish bets against some very prominent companies. This includes Nvidia, a company that has seen its stock price soar recently, and also a range of Chinese internet stocks. These are very big names, and betting against them is a bold move, you know.

In this article, we've taken a look at some important stocks that account for about 42% of Burry's Q1 portfolio. These are the positions where he has placed a significant portion of his fund's capital. His decision to bet against these specific areas of the market, especially those that have been performing very well, suggests he sees something troubling beneath the surface. It's a clear signal, perhaps, that he believes certain parts of the market are overvalued and due for a correction, or so it seems.

Frequently Asked Questions About Michael Burry

What is Michael Burry famous for?

Michael Burry is most famous for accurately predicting the 2008 housing market collapse and profiting greatly from it. He also gained widespread recognition because his story was featured in the popular book and movie called "The Big Short," you know. He's seen as someone who can spot big problems in the economy before most others do.

Did Michael Burry predict the 2008 crisis?

Yes, he absolutely did. Michael Burry predicted the 2008 housing bubble by carefully looking at how mortgage loans were being given out. He noticed the increasing risk, especially with subprime mortgages, and recognized that the housing market was heading for a major downturn. He then bet against it, which turned out to be a very smart move, so to speak.

What is Michael Burry's current market prediction?

Based on his Q1 2025 portfolio, Michael Burry's current market prediction is extremely bearish. This means he thinks the stock market, or parts of it, will go down. He has placed a lot of money on "put options," which are bets that certain stocks, like Nvidia, and Chinese internet companies will lose value. He's clearly expecting a tough time ahead, or so it appears.

What Michael Burry's Actions Might Mean Now

Michael Burry's consistent ability to identify significant market risks, you know, makes his recent moves particularly interesting. When he places such large bets, especially bearish ones, it often makes other investors stop and think. His history of seeing the big picture, even when it's unpopular, means his actions are watched very closely. It's not just about the money he makes; it's about the potential warnings he's sending to the wider market, so to speak.

His current stance, with a big focus on betting against certain high-flying stocks and sectors, suggests he sees underlying weaknesses that are not yet obvious to everyone. This could be a sign that he believes some parts of the market are due for a significant price correction. For those who follow his insights, it might be a reason to look more closely at their own investments and consider if they are prepared for potential market shifts. Learn more about market trends on our site, and you might want to link to this page to understand more about hedge funds.

Ultimately, Michael Burry's story is a reminder that truly independent thinking and deep research can lead to extraordinary outcomes in the world of investing. He is someone who has consistently challenged the prevailing wisdom, and his track record speaks for itself. Keeping an eye on what he does, even if you don't copy his moves, can offer a different perspective on the ups and downs of the financial world. It's a very unique way of looking at things, you know, and it's certainly made him a figure people talk about a lot.

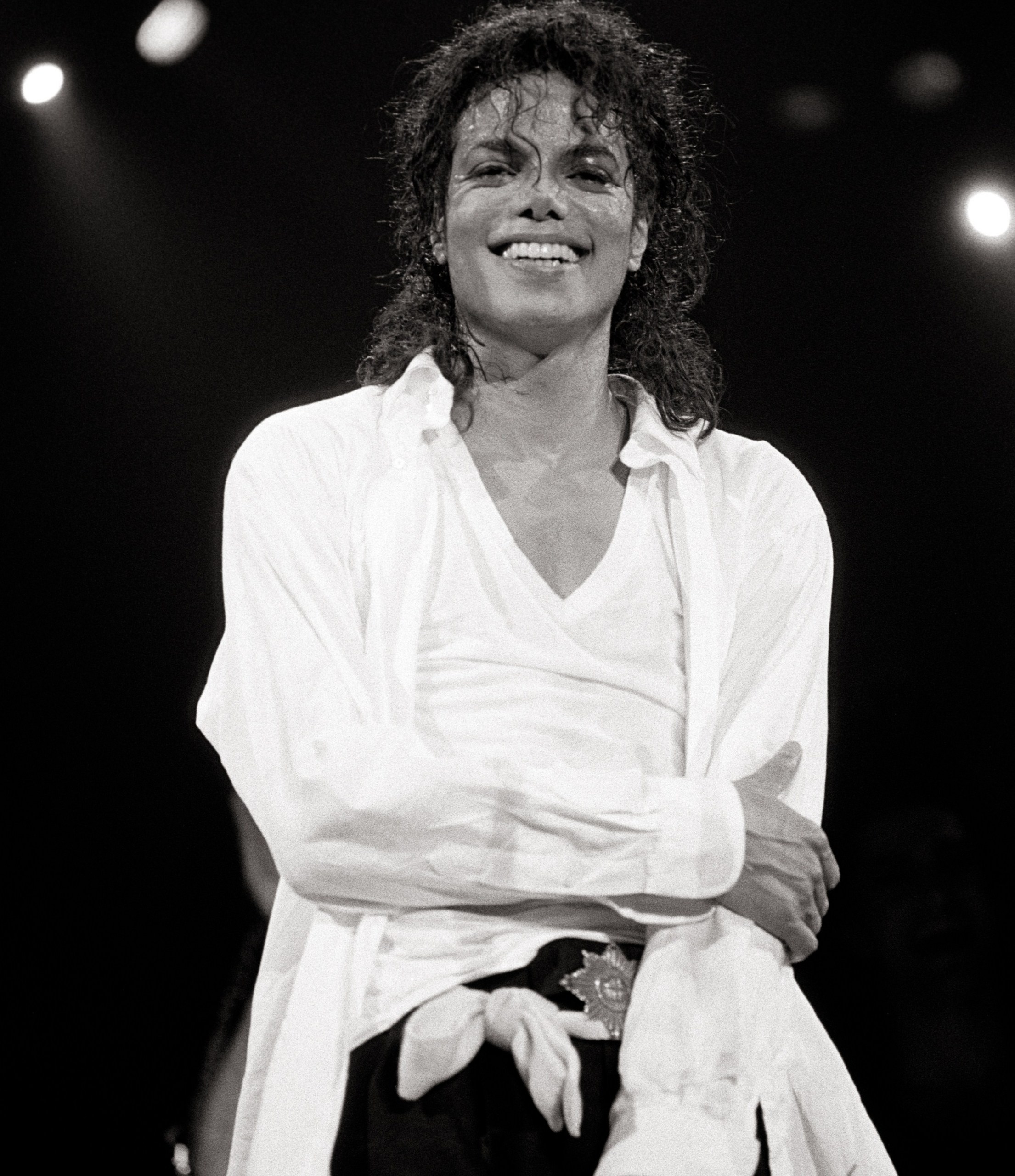

Michael Jackson Biography - The King Of POP

Michael Jackson Birthday

MICHAEL - The Bad Era Photo (25773918) - Fanpop